Working from home? You can claim home-office expenses from SARS

Updated | By Poelano Malema

Good news for those who are working from home. You might be able to claim home office expenses against tax.

Over the years, there has been an increase in people working from home.

According to the South African Revenue Service (SARS), taxpayers can claim expenses in maintaining a home office if they meet certain requirements.

The home office expenditure can include:

- rent of the premises;

- interest on bond;

- cost of repairs to the premises;

- other expenses in connection with the premises;

- phones;

- stationery;

- rates and taxes;

- cleaning;

- office equipment;

- wear-and-tear.

Who is eligible to claim?

Employees who cover their own costs of working from home can claim those costs back come tax time, provided that they have kept a slip of all the expenses. However, in order to claim, you should have been working from home for a period of six months or more. Your Human Resource personnel also needs to provide a letter saying you work from home.

Your home office must also take up at least 20 square metres. This means you need to have a dedicated workspace which can consist of office stationery and equipment. The office space must be exclusively for work.

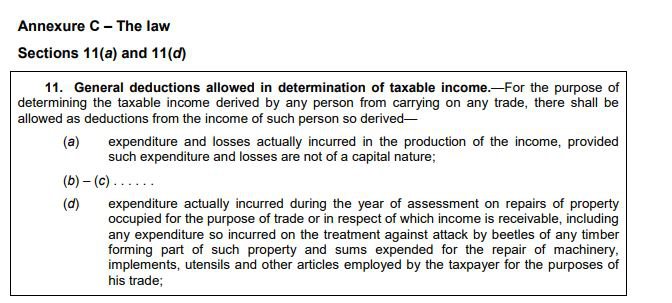

"Expenditure and losses actually incurred in the production of the income, provided such expenditure and losses are not of a capital nature," states the SARS website.

This means that if the taxpayer has incurred losses and expenses that are connected to one's earning of income, they can claim. The expense must be directly related to the business operation that is incurred by the taxpayer. For instance, if you are using your laptop and your work requires the use of electricity, those are costs related to the earning of your income.

You might be required to provide your lease agreement or your homeowner document. For claiming for electricity, you need to state how many hours you work per week and SARS will determine much electricity goes into the work time and how much is leisure.

The site also states that "expenditure actually incurred during the year of assessment on repairs of property occupied for the purpose of trade or in respect of which income is receivable, including any expenditure so incurred on the treatment against attack by beetles of any timber forming part of such property and sums expended for the repair of machinery, implements, utensils and other articles employed by the taxpayer for the purposes of his trade."

However, even if you meet the above-stated requirement, there might still be conditions that can cause your claim to be unsuccessful. For instance, if you are an employee that spends most of the time visiting clients in their homes or offices in order to perform your duty, you might not qualify for tax deductions.

Read more conditions that can cause your claim to be unsuccessful below:

To claim:

You need to file a tax return when the tax season opens and answer the questions relating to the home office. You may be required to submit proof of your claims.

Read more about how to claim for your office space here.

READ: Three simple steps for working remotely while travelling

Image courtesy of iStock/ @Christian Horz

Show's Stories

-

Woman shows how many Easter eggs she bought

How much is too much when it comes to buying Easter eggs?

The Workzone with Alex Jay 21 hours ago -

Enjoy a rainbow Easter weekend at Melrose Arch

This weekend, Melrose Arch transforms into a wonderland of colour and f...

The Workzone with Elana Afrika-Bredenkamp 21 hours ago